portability estate tax exemption

Without portability they will pay taxes on the difference between the value of your estate and the current estate tax exemption. That sounds very useful.

Newly Enhanced Estate Tax Portability Relief Under Revenue Procedure 2022 32 Tax Trusts Estates Law

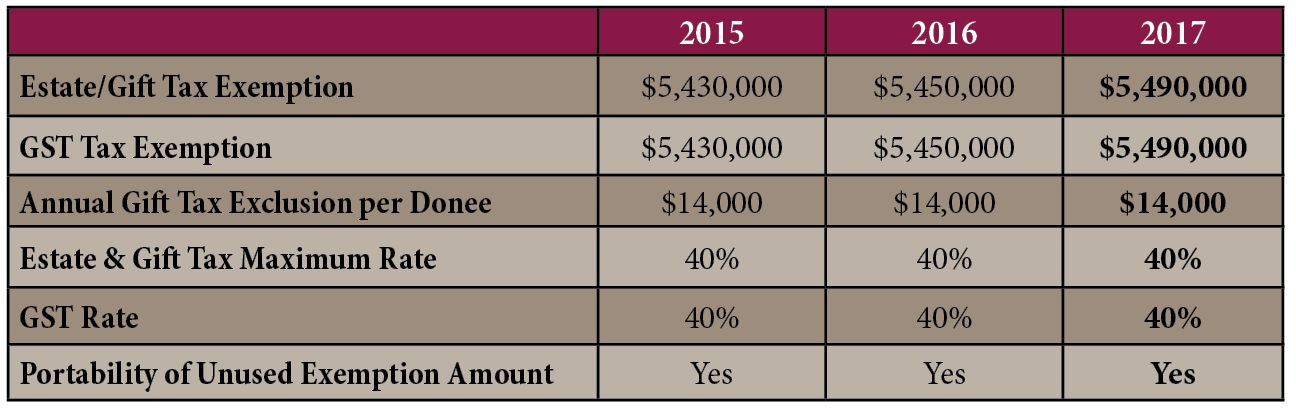

The American Taxpayer Relief Act of 2012 ATRA made permanent the portability of estate tax exemption between spouses.

. Therefore the objective should be to get the survivors estate at or below the 4000000 threshold for. Aside from increasing the estate tax gift tax and generation-skipping transfer tax exemptions to 5000000 for 2011 and 5120000 for 2012 this law introduced the concept of. By continuing to browse or by clicking Accept All Cookies you.

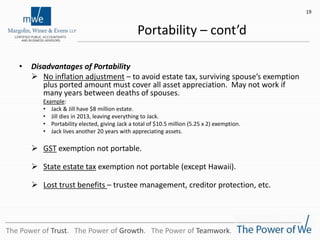

Under portability if the first spouse to die does not use his or her. IRS expands portability of a 2412 million estate tax exemption but things may change dramatically in 2026. An important change in the area of estate taxes occurred when portability elections came into play.

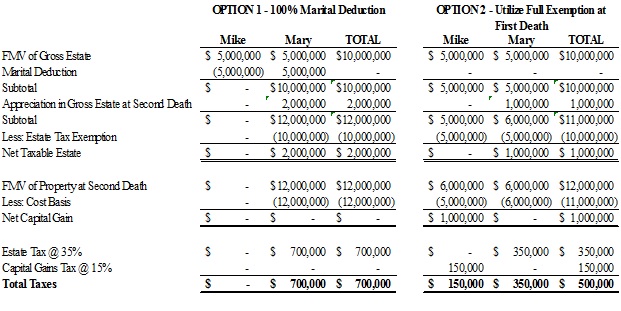

Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013. The wife has to file the IRS Form 706 federal estate tax returns to get the portability within. Portability essentially allows two spouses to combine their estate exclusions together into one large exemption.

The Tax Cuts and Jobs Act increased the federal estate tax. The estate tax exclusion allows an individual to exclude a certain. In this example that is nearly 8 million.

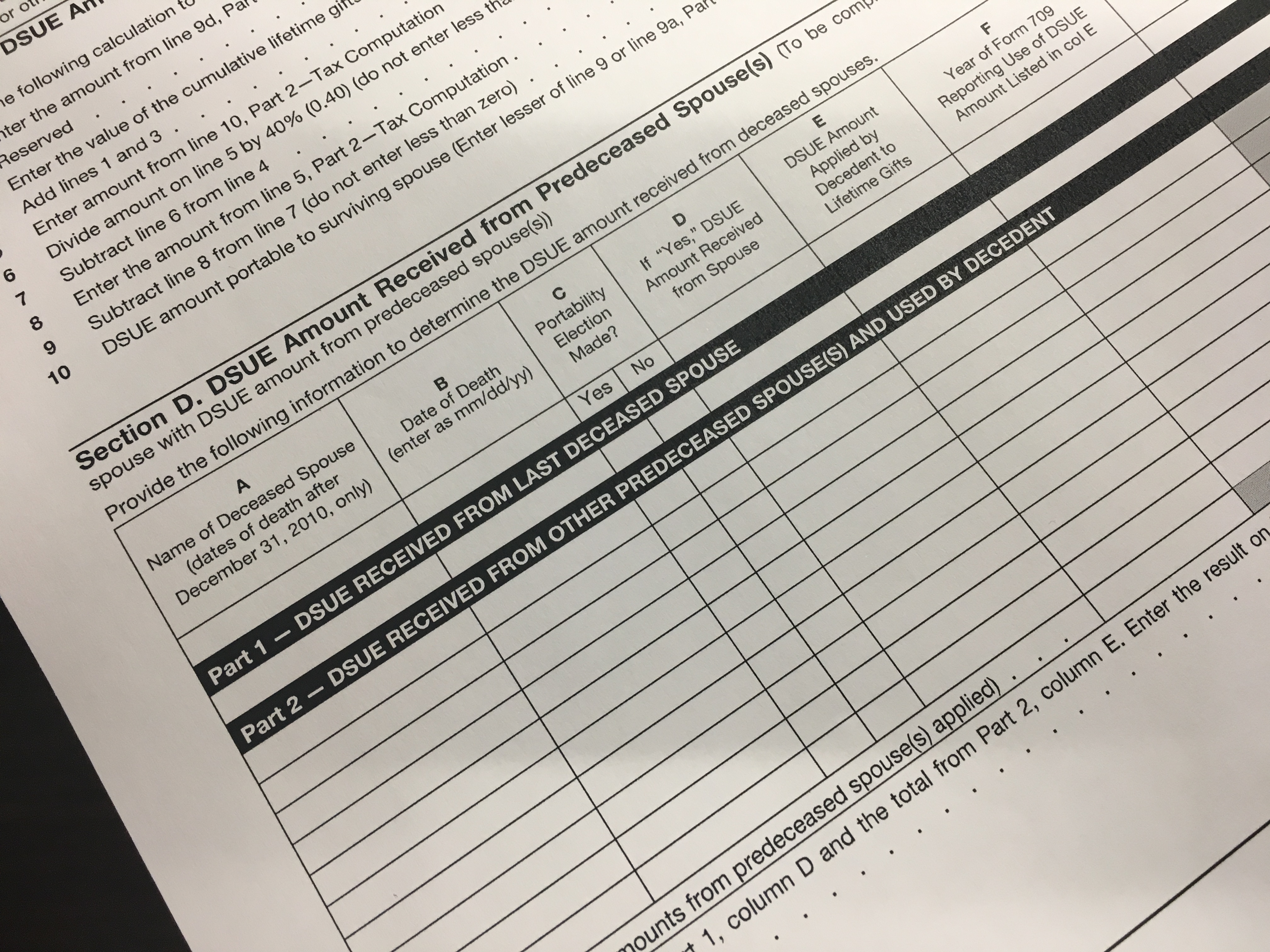

Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as. Asking the portability question. The prior spouses exemption amount would be carried over by the surviving spouse provided a federal estate tax return on IRS Form 706 was timely filed at the first death.

On July 8 2022 the Internal Revenue Service issued new guidance that allows a deceased persons estate to elect portability of their unused gift and estate tax exemption for. There is not as much need to split the exclusions and have. Assume that at the time of Jennifers later death the federal estate tax exemption is still 5340000 the estate tax rate is 40 percent and Jennifers estate is still worth 8000000.

As of that time the estate tax exemption was much lower. So there is a federal gift and estate tax and it applies. To secure the portability of the first spouses unused exemption the estate executor must file an estate tax return even if the estate is exempt from filing a return because no tax is.

On July 8 2022 the Internal Revenue Service issued new guidance that allows a deceased persons estate to elect portability of their unused gift and estate tax exemption for up to five. The non-exempted amount of 545 million would be portable and would be passed to his wife. In order to benefit from this exemption however the surviving spouse must file IRS Form 706 the United States Estate and Generation-Skipping Transfer tax return within nine months of the.

After 2012 one important question for estate planning is whether or not portability should be elected at the first death. This was just the estate tax portability rules though. Steve why dont you give us a little background on the estate tax and how portability fits into that.

It sat at 114 million for 2019 1158 million for 2020 and it has now hit 117 million. The Illinois estate tax on an estate of 16880000 would be 1524400. With exemption levels being indexed for inflation the exemption amount has gone up still.

Weiss Llp Miss The Portability Election Deadline For A Deceased Spouse S Estate Tax Exemption You May Be In Luck Weiss Llp

What Surviving Spouses Need To Know About The Marital Portability Election Natural Bridges Financial Advisors

Properly Preparing The Form 706 Estate Tax Return A 2 Part Series Ultimate Estate Planner

Estate Tax Portability What It Is And How It Works

Tax Exemption Portability Crucial In Estate Planning Spindler And Associates

Temporary Increase In Estate Tax Exemption And Portability Gudorf Law

2021 Federal Tax Changes That You Should Know Today Estate And Probate Legal Group

The 2017 Estate Tax Exemption The Ashmore Law Firm P C

Federal Estate Tax Portability The Pollock Firm Llc

What Spouses Need To Know About Portability Of The Estate Tax Exemption

Exploring The Estate Tax Part 1 Journal Of Accountancy

The Irs S New Portability Rule And The Estate Tax Financial Planning

West Palm Beach Tax Elder Law Possible Estate Tax Law Changes And The Portability Election

Portability Of A Deceased Spouse S Unused Exemption

2013 Gift Estate Planning Opportunities

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

Irs Rights To Audit Returns Filed To Elect Portability Katz Chwat Pc Long Island